Payday loans in Abbotsford, BC provide swift financial relief for residents facing unexpected expenses. These loans are accessible to individuals 19 or older with steady incomes of at least $1,200 monthly, regardless of credit history. The application process is straightforward, often resulting in same-day funding via e-transfer. With a standard fee of $14 per $100 borrowed, these loans bridge financial gaps during emergencies. The following information reveals essential details about eligibility requirements and responsible borrowing practices.

Payday Loans in Abbotsford, BC: Fast and Reliable Online Cash Solutions

Payday loans in Abbotsford, BC offer residents quick cash solutions when unexpected expenses occur, with online applications available 24/7 for almost everyone, including those with bad credit. These short-term loans help locals bridge financial gaps between paychecks, allowing them to handle emergency car repairs, urgent medical bills, or utility payments without waiting for their next income. Abbotsford residents facing temporary cash shortages can benefit from the almost guaranteed approval process that Mr. Payday offers, as long as they meet basic criteria like being at least 19 years old and having a monthly income of at least $1,200. For those in urgent financial situations, same-day payday loans in Abbotsford provide immediate relief when traditional lending options are unavailable.

What Are Payday Loans in Abbotsford, BC?

Life's unexpected expenses can catch anyone off guard, which is why many Abbotsford residents turn to payday loans when they need quick cash between paychecks. Payday loans are short-term cash advances that help cover costs until your next payday arrives. These payday loan overview services provide a practical solution for BC residents facing emergency car repairs, surprise medical bills, or utility payments they can't afford to miss. Unlike traditional loans, payday advances in Abbotsford don't require good credit, making them accessible to almost everyone who meets basic criteria. The application takes minutes to complete, with funds often sent via e-transfer the same day during business hours. When exploring monetary support options in Abbotsford, payday loans offer a simple way to bridge short gaps between income periods.

Benefits of Using Payday Loans in Abbotsford, BC

When unexpected expenses arise between paychecks, residents of Abbotsford often find themselves searching for quick financial solutions without lengthy approval processes. Payday loans present several short term borrowing advantages that make them appealing for those facing temporary cash shortages.

| Payday Loan Advantages | Benefits to Abbotsford Residents |

|---|---|

| Speed of Access | Money sent via e-transfer within hours |

| Bad Credit Acceptance | Past credit issues don't block approval |

| Simple Requirements | Just need income, bank account, and phone |

| 24/7 Online Application | Apply anytime, even on weekends |

These loans help bridge financial gaps until your next pay date arrives, providing peace of mind during stressful situations. For Abbotsford residents dealing with car repairs, medical bills, or other urgent expenses, payday loans provide a feasible solution without complex paperwork or long waiting periods.

Who Should Consider Payday Loans in Abbotsford, BC?

Many Abbotsford residents find themselves caught between paychecks, wondering how to manage sudden expenses that can't wait until their next payday. Payday loans offer a solution for those facing urgent car repairs, unexpected medical bills, or essential home fixes that cannot be postponed. Working adults with regular income from employment, EI, CPP, or Child Tax Benefits who need quick cash should consider these short-term options. Individuals with less-than-perfect credit histories can apply, as Mr. Payday evaluates applications based on income rather than credit scores. Payday loan benefits include fast access to funds without lengthy approval processes, making them suitable for time-sensitive situations. Responsible borrowing means taking only what you need and having a clear plan to repay on your next payday.

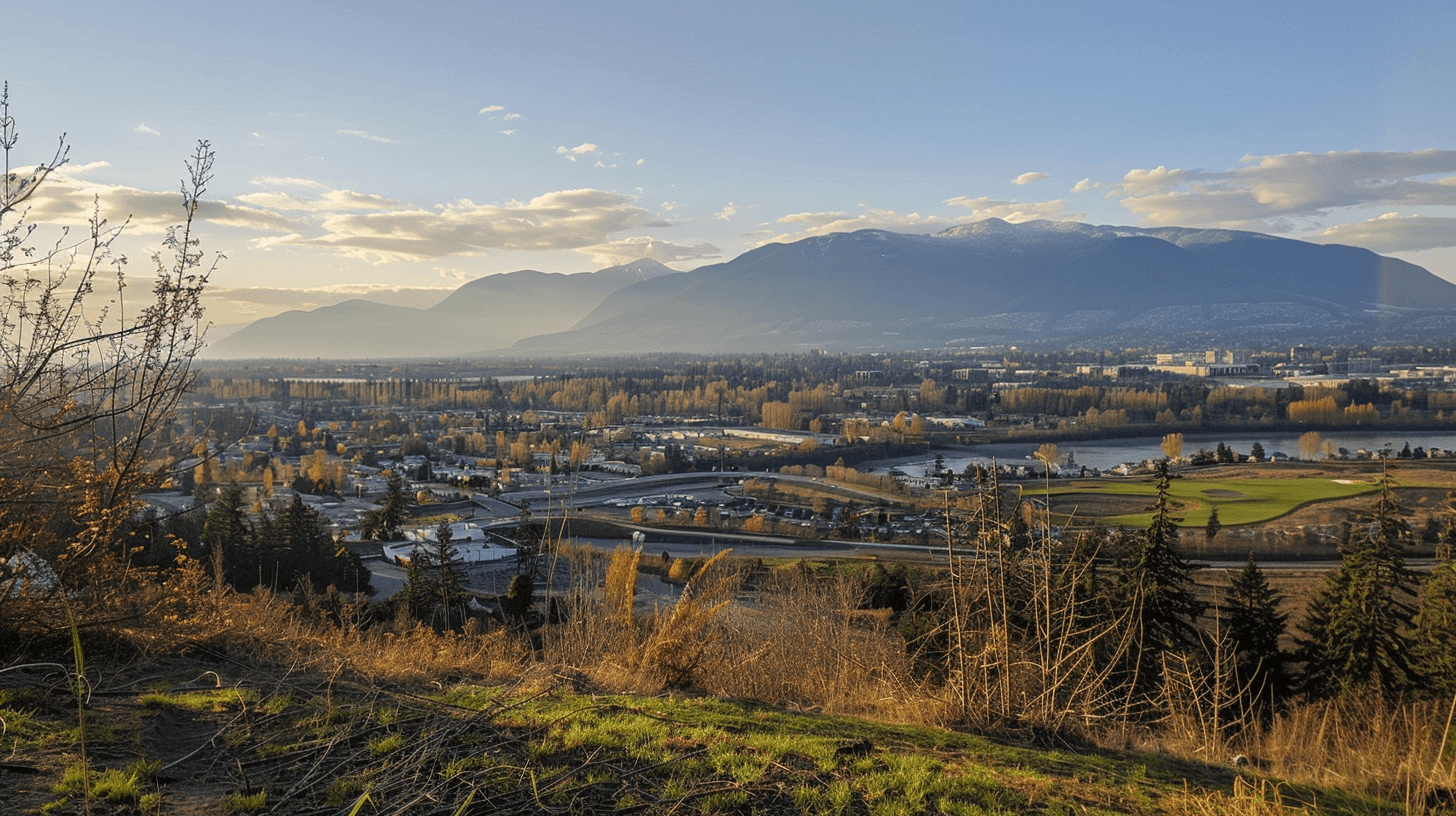

Living in Abbotsford, BC: Cost of Living and Financial Challenges

Life in Abbotsford has become increasingly expensive, with housing costs, groceries, and transportation showing notable increases over recent years. Many local residents face growing pressure to balance their monthly budgets while managing unexpected expenses that can disrupt even careful financial planning. When emergency situations occur, whether car repairs, medical costs, or utility bills, short-term cash options provide Abbotsford residents with ways to handle these challenges without delay. British Columbia residents seeking immediate financial assistance sometimes turn to payday loans in BC as a short-term solution for unexpected expenses.

Rising Expenses in Abbotsford, BC and Their Impact

Living in Abbotsford, BC presents unique economic difficulties for residents, as the cost of living continues to climb despite being more affordable than nearby Vancouver. Housing costs remain the primary burden for many families, with rising inflation pushing prices upward despite the 49% lower costs compared to Vancouver. Housing affordability continues to be a challenge with the average detached home costing over $1.2 million, resulting in monthly payments of approximately $5,200.

- Median household income stands at $90,000 annually, yet the price-to-income ratio sits at a concerning 8.7

- Monthly expenses for a single person typically reach $3,535, including rent

- Utility costs begin at $150 monthly, while strata fees can exceed $500 for older apartments

- Food costs, though 25% cheaper than Vancouver, still average $527 monthly per household

How Financial Stress Affects Residents in Abbotsford, BC

Financial strain weighs heavily on Abbotsford residents as they navigate the complexities of an ever-changing economic landscape. With an average annual salary of $45,468 and hourly wage of $19.36, many families struggle to meet basic needs. The poverty gap remains significant, with lone parents facing a $13,177 shortfall and couples with two children experiencing a $13,984 gap.

| Economic Factor | Impact | Solution |

|---|---|---|

| Child poverty (14.3%) | Limited resources | Community support |

| Inflation (3.9%) | Higher living costs | Financial literacy |

| Unemployment (5.2%) | Income instability | Short-term loans |

These challenges are especially pronounced for vulnerable groups, including the 40.4% of lone-parent families living in poverty. While Abbotsford offers lower utility costs than Vancouver, residents still face housing pressures with new tenants paying 27% more than existing ones.

How Payday Loans Help Address Short-Term Cash Needs

When unexpected expenses arise in Abbotsford, payday loans provide a feasible solution for residents facing temporary cash shortages between pay periods. Many Abbotsford citizens turn to these short-term options when confronted with urgent costs that can't wait until their next paycheck. The quick application process and minimal requirements make payday loans accessible for those who might not qualify for traditional banking services.

- Car repairs that prevent commuting to work in Abbotsford's spread-out communities

- Unexpected medical expenses not covered by provincial health insurance

- Emergency home repairs, especially during harsh winter conditions

- Utility bill payments to avoid service disconnection

Payday loans bridge financial access gaps for Abbotsford residents experiencing short term emergencies, offering a lifeline when traditional options aren't available or take too long to process.

Who Can Apply for Payday Loans in Abbotsford, BC?

Many Abbotsford residents wonder if they qualify for payday loans, especially when facing unexpected bills or expenses between paychecks. Understanding the basic eligibility requirements can help potential borrowers determine if this short-term borrowing option is available to them, regardless of their credit history. Knowing the common reasons applications get rejected can also save time and help applicants prepare properly for the loan process. Even those with bad credit in BC can often find emergency financing options when traditional lenders turn them down.

Basic Eligibility Criteria for Payday Loans in Abbotsford, BC

People living in Abbotsford often wonder if they qualify for payday loans, especially those with less-than-perfect credit histories. Understanding the eligibility criteria helps clear up common misconceptions about who can apply. In British Columbia, Mr. Payday accepts applications from individuals who meet basic requirements, with almost everyone approved if they satisfy these conditions.

- Must be 19 years or older and a resident of British Columbia

- Need a steady income source of at least $1,200 monthly (can include CPP, EI, or Child Tax Credit)

- Require an active Canadian bank account where income is deposited

- Must provide a valid phone number where you can be reached

Bad credit isn't a barrier, as no credit checks are conducted when applying.

Can You Get a Payday Loan in Abbotsford, BC with Bad Credit?

Bad credit often stands as a major concern for individuals seeking financial support in Abbotsford, but the payday loan industry offers solutions that traditional lenders typically don't. Mr. Payday works with applicants who have poor credit histories, making loans available to those who meet basic eligibility criteria rather than concentrating on credit scores.

To qualify for a payday loan in Abbotsford, applicants must be at least 19 years old (BC's legal age requirement), have a steady income of at least $1,200 monthly, maintain an active Canadian bank account, and provide a valid phone number. Income can come from various sources including employment, CPP, EI, WCB benefits, or Child Tax Credit. Applications might be declined if bank accounts show irregular income deposits or multiple NSF issues, but credit history alone won't disqualify most borrowers.

Common Reasons Payday Loan Applications Are Rejected

Payday loan applicants in Abbotsford, BC often face uncertainty about who qualifies and why some applications get rejected. Understanding common application issues can help borrowers prepare better when applying with lenders like Mr. Payday. Most rejections stem from not meeting basic eligibility criteria rather than credit history concerns.

- Bank accounts showing multiple NSF (insufficient funds) transactions suggest payment difficulties

- New or inactive bank accounts without regular income deposits raise red flags for lenders

- Income that falls below the minimum threshold of $1,200 monthly will result in denial

- Inability to verify income sources through banking records, which is why direct deposits matter

While bad credit doesn't typically cause rejection, these practical factors help lenders determine if applicants can repay their loans on schedule.

The Features and Benefits of Payday Loans in Abbotsford, BC

Payday loans in Abbotsford, BC offer practical features that make them a popular choice for short-term cash needs. Borrowers can access amounts ranging from $100 to $1,500 based on their income level, with repayment typically aligning with their next payday. These loans stand out for their speed and accessibility, with applications available online 24/7 and funds often sent via e-transfer within hours of approval. Similar to emergency loans in Edmonton, these financial products provide rapid solutions for unexpected expenses without requiring extensive credit checks.

Loan Amounts and Repayment Terms

Residents of Abbotsford facing unexpected bills or emergency expenses can access quick financial help through payday loans ranging from $100 to $1,500. The loan amount depends on your income level, with most lenders offering up to 50% of your regular paycheck. Repayment options align with your pay schedule, creating a straightforward borrowing experience.

- Loan amounts vary from $100 to $1,500 based on qualifying income

- Repayment periods typically span 14 to 62 days, matching your pay cycle

- Funds can be sent via email money transfer within hours of approval

- Repayment occurs automatically through bank account withdrawal on your payday

This loan flexibility allows Abbotsford residents to manage short-term cash flow challenges without complex approval processes, making payday loans a practical solution for time-sensitive monetary requirements.

No Credit Check and Fast Approval Process

Getting approved for a loan when you have bad credit or a less-than-perfect financial history can be challenging in Abbotsford, BC. Unlike traditional lenders who place heavy emphasis on credit scores, payday loan providers focus primarily on your current income and employment status. Most Abbotsford payday lenders don't conduct traditional credit checks, opening doors for those with no credit history or past monetary difficulties. The approval process evaluates your ability to repay based on your income rather than your credit past. This approach makes these loans more attainable for many Abbotsford residents facing temporary cash shortages. Applications typically receive responses within hours, with fast funding often completed the same day through e-transfers. For those facing urgent bills or unexpected expenses, this quick turnaround can make a significant difference in managing short-term financial hurdles.

E-Transfer Funding and 24/7 Online Applications

Online banking conveniences have transformed how Abbotsford residents access emergency funds when they need them most. Mr. Payday's e-transfer convenience means approved applicants typically receive their funds within 30 minutes of approval, allowing them to address urgent expenses without delay. The fully digital online application system operates 24/7, making it possible to apply for loans during weekends or late hours when traditional banks are closed.

- Apply from any device with internet access, any time of day

- Track your application status through a personal customer page

- Receive funds via e-transfer without leaving your home

- Complete the entire process without scanning, emailing, or faxing documents

This modern approach to lending suits the busy lives of Abbotsford residents who need quick solutions for unexpected bills or expenses.

Applying for Payday Loans in Abbotsford, BC: A Step-by-Step Guide

Applying for a payday loan in Abbotsford, BC is a straightforward process designed to connect borrowers with funds quickly when unexpected expenses occur. The online application system allows Abbotsford residents to apply from anywhere, at any time, without the hassle of visiting a physical location or dealing with paperwork. Understanding what information you'll need beforehand, how the application works, and what happens after approval can help make your borrowing experience smooth and stress-free. For those concerned about credit history, nearby options include no credit check loans in Alberta that provide financial alternatives when traditional lenders decline applications.

How to Apply for Payday Loans in Abbotsford, BC Online

The application process for payday loans in Abbotsford has become remarkably simple thanks to online platforms that allow residents to submit their information from home. Mr. Payday offers a fast online application process that takes just minutes to complete, with almost everyone approved if they meet basic criteria. The company provides 24/7 access to applications, making it easy for those with bad credit to apply whenever an emergency arises.

- Visit Mr. Payday's website and fill out the secure application form

- Provide government-issued ID and proof of income (minimum $1,200 monthly)

- Include your active Canadian bank account details for e-transfer

- Supply a valid phone number and email address for updates

What Information Do You Need to Apply?

Many residents of Abbotsford, BC find the payday loan application process straightforward when they have all required information ready beforehand. The application typically asks for basic personal details that help verify your identity and ability to repay the loan.

When applying with Mr. Payday, you'll need to provide government-issued photo ID to confirm your age (19 or older in BC), proof of income showing you earn at least $1,200 monthly, and details for an active Canadian bank account where your income is deposited. You must also supply a working phone number for contact purposes. Mr. Payday doesn't request credit checks, making the process accessible for those with bad credit or past bankruptcies. Having these items prepared helps guarantee your application moves quickly through the system without delays.

What Happens After Approval?

Once your payday loan has been approved in Abbotsford, BC, a clear sequence of events unfolds to get money into your hands quickly. The post approval process includes receiving a thorough loan agreement that outlines all terms, conditions, and repayment expectations. Mr. Payday emphasizes transparency throughout this final stage, ensuring you understand your obligations before funds are released.

- You'll receive your loan agreement via email with loan agreement details including the exact amount borrowed and repayment date

- After reviewing and accepting the terms, you'll digitally sign the agreement online

- Funds are sent directly to your bank account via email money transfer, typically within 30 minutes during business hours

- Your repayment date is automatically scheduled to coincide with your next payday, with the amount debited directly from your account

Understanding Payday Loan Costs and Repayments in Abbotsford, BC

Understanding the costs associated with payday loans in Abbotsford is essential before applying for one. In British Columbia, payday loan fees are regulated at $14 per $100 borrowed, making it clear exactly how much you'll need to repay. These transparent fee structures help borrowers make informed decisions about their short-term cash needs. Many residents find same-day payday loans particularly useful in emergency situations when unexpected expenses arise.

How Much Do Payday Loans Cost in Abbotsford, BC?

The cost of payday loans in Abbotsford follows British Columbia's provincial regulations, which set a standard fee of $14 for every $100 borrowed. This means a $300 loan would cost $342 to repay, while a $500 loan would require a $570 repayment. These payday loan fees are fixed, transparent, and consistent across all licensed lenders in the province, helping borrowers comprehend their exact obligations.

- A $1,000 loan costs $1,140 to repay on your next payday

- All fees must be disclosed upfront before you sign any loan agreement

- NSF charges apply if your account lacks funds on the repayment date

- Understanding the total cost helps with planning effective repayment strategies

Smart borrowers mark their repayment date on their calendar and guarantee sufficient funds are available to avoid additional charges.

Tips for Managing Payday Loan Repayments

Successful management of payday loan repayments starts with clear knowledge of your financial obligations and a solid plan to meet them on time. Creating a budget that accounts for your loan repayment should be your top priority after receiving funds. Mark your calendar with the exact due date, which typically falls on your next payday, to avoid missing payments.

Setting up automatic payments through your bank can help prevent late fees and NSF charges of at least $20 per occurrence. Good budgeting strategies include setting aside the repayment amount immediately, tracking all expenses, and cutting non-essential costs until the loan is paid. Developing repayment plans before taking out the loan helps borrowers understand the full commitment. Contact Mr. Payday right away if you foresee any issues making your payment on time.

What Happens If You Miss a Payment?

Missing a payment for your payday loan in Abbotsford comes with specific consequences that borrowers should be aware of before taking out a loan. When funds aren't available on your payment date, both Mr. Payday and your bank may charge NSF fees, adding to your total debt. Missed payments can quickly turn a short-term solution into a complex problem with financial consequences.

- A minimum $20 NSF fee applies each time a payment bounces

- Your bank will likely add their own NSF charge, often $45-$50

- Missed payments may be reported to credit bureaus, affecting your credit history

- Mr. Payday may contact you to arrange alternative payment methods via e-transfer

Understanding these potential outcomes helps borrowers take payday loans more seriously and plan for on-time repayment.

Borrowing Responsibly: Making Payday Loans in Abbotsford, BC Work for You

Borrowing money through payday loans in Abbotsford, BC requires careful thought about when such loans are truly helpful versus when they might cause more harm than good. While payday loans can serve as valuable tools during genuine emergencies like car repairs or urgent medical expenses, they should never become a regular part of your monthly budget planning. Similar to the options available in nearby communities, residents of Abbotsford can also consider same-day payday loans as an emergency solution when facing unexpected financial challenges. Understanding both the appropriate circumstances for using these loans and the available alternatives in Abbotsford can help you make smarter borrowing decisions that protect your long-term financial health.

When Should You Use a Payday Loan?

When unexpected expenses arise in Abbotsford, BC, payday loans can serve as a helpful short-term solution for many residents facing cash shortages between pay periods. These loans work best for specific situations where immediate funds are needed to handle pressing matters before your next paycheck arrives. Understanding when to use payday loans can help you make sound borrowing decisions while avoiding potential cash flow problems.

- Car repairs that prevent you from getting to work

- Urgent medical expenses not covered by provincial healthcare

- Emergency home repairs like broken water pipes or heating issues

- Avoiding utility disconnections or late rent penalties

Payday loans should be used thoughtfully, primarily for genuine emergency expenses rather than regular spending or ongoing bills. Before applying, consider if the expense truly cannot wait until your next payday.

How to Avoid Over-Reliance on Payday Loans

While payday loans offer quick cash solutions in Abbotsford, BC, developing good financial habits can help residents avoid becoming dependent on these short-term loans. Creating a workable budget that tracks income and expenses allows people to spot potential shortfalls before they become emergencies. Sound financial planning includes building an emergency fund, even if just a small amount each month, to cover unexpected costs without borrowing. Many Abbotsford residents find that using budgeting techniques like the envelope method or 50/30/20 rule helps manage money more effectively. Setting aside time each week to review finances and cutting non-essential spending can create breathing room in tight budgets. When cash flow improves, prioritizing savings helps break the cycle of relying on loans for regular expenses.

Payday Loan Alternatives in Abbotsford, BC

Abbotsford residents facing urgent cash needs have several options to evaluate before turning to payday loans. Building emergency savings, even just $500, can help manage many unexpected costs without borrowing. Local credit unions often offer small personal loans with lower fees than payday options for those who qualify.

- The Abbotsford Community Services provides emergency assistance programs for residents in critical situations

- Local religious organizations often maintain benevolence funds to help community members

- Many employers offer payroll advances when employees face unexpected expenses

- Utility companies typically allow payment arrangements before service disconnection

Community resources like the Salvation Army and food banks can also help free up money during tight times. For those who've exhausted these options, payday loans should be approached as a last resort rather than a regular solution.

FAQs About Payday Loans in Abbotsford, BC

Many Abbotsford residents have questions about how payday loans work in BC, what credit requirements exist, and how quickly they can access funds. Understanding these key aspects helps individuals make informed decisions when considering short-term borrowing options. This FAQ section addresses the most common questions to provide clarity for those exploring payday loans in Abbotsford. Similar options are available for payday loans in Vancouver, which offer quick access to emergency funds for those in need.

What Are Payday Loans in Abbotsford, BC and How Do They Work?

Payday loans offer Abbotsford residents a quick solution when unexpected expenses arise between paydays. These short-term loans, governed by BC payday loan regulations, provide funds until your next paycheck arrives. The process starts with an application, followed by approval based on income rather than credit history, making these quick cash solutions accessible to many Abbotsford residents.

- Loans typically range from $100 to $1,500 based on your income

- Repayment occurs on your next payday through automatic bank withdrawal

- Applications can be completed online in minutes, 24/7

- Funds are sent via email money transfer, often within hours of approval

Unlike traditional loans, payday advances focus on your current income stability rather than past credit performance, helping when you need cash quickly.

Can You Get a Payday Loan in Abbotsford, BC Without a Credit Check?

Yes, you can get a payday loan in Abbotsford, BC without a traditional credit check, which makes these loans accessible to people with bad credit, no credit history, or past financial difficulties. Instead of checking your credit score, lenders like Mr. Payday focus on your income stability and bank account activity to determine if you qualify for a loan.

Payday loan regulations in Abbotsford guarantee that borrowers with varied credit backgrounds can access short-term funds when they need them. The eligibility criteria typically include having a regular income of at least $1,200 monthly, an active bank account, and being at least 19 years old in BC. This approach allows almost everyone to be approved for emergency cash when unexpected expenses come up, making these loans a viable option for many Abbotsford residents.

How Quickly Can You Receive Payday Loan Funds in Abbotsford, BC?

When facing unexpected expenses in Abbotsford, BC, the speed of receiving loan funds can make all the difference. Mr. Payday's loan processing system works efficiently to help Abbotsford residents access cash when they need it most. Applications submitted during business hours often receive approval within an hour, with funds following shortly after.

- E-transfers deliver money to approved applicants typically within 30 minutes after approval

- Online applications are available 24/7, though actual funding follows business hours

- Fast funding is possible because the verification process is built into the application

- Applicants in Abbotsford can track their application status through their personal customer page

While traditional banks might take days to process loans, payday loans offer a quicker solution for urgent situations in Abbotsford.

Conclusion: Get Fast, Reliable Payday Loans in Abbotsford, BC Today

Payday loans in Abbotsford, BC offer essential short-term cash solutions for residents facing unexpected bills, car repairs, or medical expenses. Mr. Payday stands as a trusted direct lender in Abbotsford, following British Columbia's regulations while providing transparent, no-hidden-fee services to applicants regardless of credit history. The online application runs 24/7, allowing Abbotsford residents to apply from home and potentially receive funds via e-Transfer within hours of approval. For those needing alternatives, instant loans in BC provide quick approval options with minimal documentation requirements.

Why Mr. Payday Is a Trusted Payday Loan Provider in Abbotsford, BC

Finding a trusted payday loan provider in Abbotsford, BC can make all the difference when unexpected expenses arise. Mr. Payday stands out among trustworthy lenders in Abbotsford as a direct lender following provincial regulations, with clear pricing and no hidden fees. Since 2002, they've been helping BC residents manage short-term cash needs with a focus on customer service.

Their advantages include:

- 24/7 online applications from anywhere in Abbotsford

- No credit checks for applicants with bad credit or past bankruptcies

- Same-day e-Transfer funding, often within 30 minutes of approval

- Simple repayment directly from your bank account on your payday

Apply today and experience why many Abbotsford residents choose Mr. Payday for short-term loans up to $1,500 when they need cash quickly.

Apply Now for Same-Day E-Transfer Payday Loans in Abbotsford, BC

Ready to solve your cash flow challenges in Abbotsford? Mr. Payday offers a simple way to get funds when you need them most. The online application takes just minutes to complete, with almost guaranteed approval for those who meet basic criteria. You can apply 24/7 from your home, workplace, or anywhere with internet access.

When approved, your money arrives via email transfer, often within 30 minutes during business hours. This fast cash solution helps Abbotsford residents handle car repairs, medical bills, or other unexpected costs without delay. The easy application process requires no document scanning or faxing, and you'll know your status quickly.

Don't let money worries linger when a solution is just a click away. Apply online today and experience how Mr. Payday can help.