Payday loans in Abbotsford, BC, provide quick, accessible financial aid for sudden expenses like medical bills or car repairs. Ideal for those with poor credit, these loans emphasize income stability without a credit check. With amounts ranging from $100 to $1,500 and a straightforward online application, funds can be accessed swiftly, often within hours. Understanding the fixed repayment cost of $14 per $100 borrowed is essential, encouraging responsible borrowing. Discover how these loans can fit your urgent needs efficiently.

Payday Loans in Abbotsford, BC: Fast and Reliable Online Cash Solutions

Payday loans in Abbotsford, BC, stand as a fast and reliable solution for those experiencing short-term financial setbacks, offering a clear path for individuals needing immediate cash access. These loans are especially advantageous for covering unexpected expenses like medical bills or urgent car repairs, providing a safety net when traditional credit options may not be viable. With an emphasis on accessibility, payday loans guarantee that even those with bad credit can secure the funds they need quickly, adhering to provincial regulations to maintain transparency and trust. Quick Cash Solutions offers same-day payday loans for Abbotsford residents facing financial emergencies.

What Are Payday Loans in Abbotsford, BC?

In the bustling city of Abbotsford, BC, payday loans serve as a lifeline for those in need of quick financial relief. These loans are small, short-term financial tools designed to help cover expenses until the next paycheck, offering a practical solution for temporary cash flow issues. They are regulated financial products, ensuring transparency and responsible borrowing. Payday loans are particularly useful in situations like urgent medical expenses or unexpected utility bills.

- 24/7 Availability: Accessible any time, providing convenience.

- No Credit Check: A viable option for those with bad credit.

- Online Application: Simple and quick to apply for.

- e-Transfer Funding: Typically funded within hours.

- Regulated Products: Adhere to provincial guidelines, ensuring trustworthiness.

These features make payday loans a reliable choice in Abbotsford.

Benefits of Using Payday Loans in Abbotsford, BC

When facing unexpected expenses, many find payday loans in Abbotsford, BC to be an essential resource, offering quick cash solutions just when they're needed most. These loans provide crucial monetary emergency support, addressing urgent requirements like medical bills, car repairs, or utility payments. One of the key payday loan benefits is their accessibility; applicants can secure funds without a traditional credit check, making them ideal for those with bad credit. With a straightforward online application process available 24/7, borrowers can receive funds via e-transfer swiftly, often within hours. Regulated by provincial standards, payday loans in Abbotsford guarantee transparent fee structures, fostering trust and reliability. This responsible lending approach positions payday loans as a practical solution for short-term monetary requirements.

Who Should Consider Payday Loans in Abbotsford, BC?

Why might someone in Abbotsford consider payday loans as a viable financial solution? Payday loans can be an option for individuals facing unexpected expenses between paychecks. They offer quick access to cash without the need for a traditional credit check, making them accessible to those with poor credit. Here are situations where payday loan benefits might be most relevant:

- Urgent medical expenses that arise suddenly, requiring immediate payment.

- Car repairs necessary to maintain daily transportation.

- Unexpected utility bills that need settling to avoid service disruptions.

- Shortfalls in rent that could lead to housing issues.

- Emergency situations where fast cash is essential.

Emphasizing responsible borrowing, payday loans are regulated to guarantee transparency and fair practices, offering a trusted option for temporary financial relief.

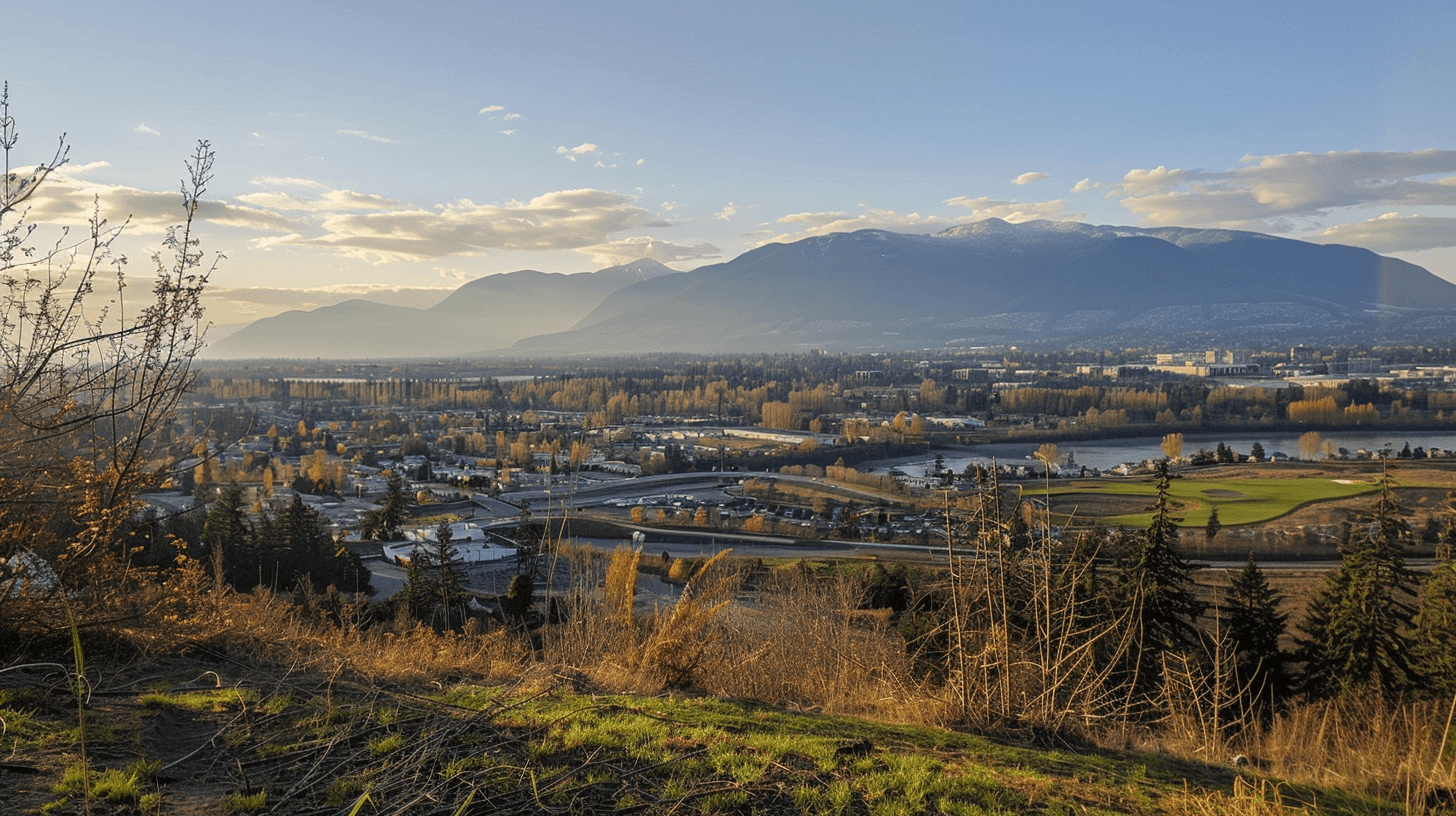

Living in Abbotsford, BC: Cost of Living and Financial Challenges

Abbotsford, BC is experiencing a noticeable rise in living expenses, with housing, groceries, and transportation costs putting increased pressure on residents' finances. This financial strain is leading to heightened levels of stress and insecurity among individuals who find it challenging to meet their monthly obligations. In these circumstances, some residents turn to payday loans as a viable solution for managing unexpected short-term expenses, helping them bridge cash flow gaps between paychecks. Understanding the regulations of payday loans in BC is crucial for residents considering this financial option during emergency situations.

Rising Expenses in Abbotsford, BC and Their Impact

In recent years, the cost of living in Abbotsford, BC has been climbing steadily, impacting residents across the board. With rising costs in housing, transportation, and utilities, the financial pressures on residents are intensifying. Housing remains a significant burden, with average monthly rents and mortgage payments soaring. Additionally, the cost of living comparison reveals:

- Housing costs: 49% lower than Vancouver, yet still burdensome.

- Transportation: Public transit and gas prices contribute to expenses.

- Utilities and internet: Add $150+ to monthly bills.

- Food: 25% cheaper than Vancouver but still a concern.

- Median household income: Fails to match the price-to-income ratio, which is considered unaffordable.

These factors collectively strain household budgets, compelling many to seek financial solutions.

How Financial Stress Affects Residents in Abbotsford, BC

Financial stress, a persistent shadow over many residents in Abbotsford, BC, continues to shape daily life in ways that are both profound and multifaceted. With 44% of Canadians citing money as their leading stressor, financial impacts are evident in Abbotsford. Rising grocery prices, inflation, and housing costs are significant stressors, affecting sleep and mental health for nearly half of the population. Younger residents under 35 are particularly vulnerable, with 72% reporting negative outcomes such as anxiety and depression. Stress management becomes essential, as 91% of Canadians take steps to alleviate financial burdens. Despite Abbotsford's relatively low unemployment rate and rising median incomes, economic challenges persist, highlighting the need for effective financial strategies and support systems in the community.

How Payday Loans Help Address Short-Term Cash Needs

For many residents of Abbotsford, BC, the rising cost of living can create economic hurdles that are difficult to navigate. Short-term borrowing, such as payday loans, offers a lifeline during financial emergencies. These loans can help residents manage:

- Unexpected car repairs that can't be postponed.

- Medical bills arising suddenly and requiring immediate attention.

- Rent shortfalls that leave tenants scrambling for funds.

- Cash flow gaps between pay periods, causing temporary financial strain.

- Limited traditional credit access due to poor credit history.

Using payday loans, residents can address immediate needs without the hurdles of traditional lending. While not a solution for ongoing financial problems, payday loans can provide essential support during urgent situations, ensuring stability during unexpected financial shocks.

Who Can Apply for Payday Loans in Abbotsford, BC?

In Abbotsford, BC, payday loans are accessible to a wide range of individuals, provided they meet certain basic eligibility criteria, such as being a resident of the province and at least 19 years of age. These loans are particularly appealing to those with bad credit, as no traditional credit check is required, making them an option for individuals who might otherwise face difficulties obtaining monetary support. However, applications can be declined for reasons such as having a new or inactive bank account, frequent non-sufficient fund occurrences, or income that doesn't meet the lender's requirements. Similar to payday loans in Vancouver, these financial products offer quick access to funds for emergency situations, though terms may vary by location.

Basic Eligibility Criteria for Payday Loans in Abbotsford, BC

Payday loans in Abbotsford, BC, provide a feasible solution for those facing unexpected expenses and needing quick access to cash. Understanding the eligibility overview is vital for potential applicants. To qualify, individuals should be aware of specific application considerations:

- Age and Residency: Applicants must be at least 18 years old and residents of BC.

- Income Requirements: A steady income source such as employment wages, EI, CPP, CTC, or private disability benefits is necessary.

- Bank Account: An active Canadian bank account is essential for e-Transfer and loan repayment.

- No Credit Check: These loans are accessible to those with bad or no credit history.

- Common Rejection Reasons: New or inactive bank accounts, frequent NSF occurrences, and unverifiable income may lead to denial.

Can You Get a Payday Loan in Abbotsford, BC with Bad Credit?

Wondering if you can get a payday loan in Abbotsford, BC with bad credit? The good news is that payday loans are accessible to many, even those with poor credit histories. The qualifying criteria focus mainly on age, income, and bank account status. Applicants must be at least 19 years old and have a stable income from sources like employment, EI, or CPP. A common application misconception is that a good credit score is necessary, but no traditional credit check is conducted. However, it's vital to have an active Canadian bank account for receiving funds and loan repayment.

| Criteria | Requirement |

|---|---|

| Age | At least 19 years old |

| Income Sources | Employment, EI, CPP, CTC, disability benefits |

| Bank Account | Active Canadian bank account |

| Credit Check | Not required |

This guarantees the application process is inclusive and straightforward.

Common Reasons Payday Loan Applications Are Rejected

For residents of Abbotsford, BC, seeking to understand who can apply for payday loans, it's important to grasp the basic eligibility criteria and common rejection pitfalls. Application eligibility is essential, as meeting the lender's requirements can greatly increase approval chances. However, some common rejection factors can impede this process. These factors can include:

- New or inactive bank accounts that lack regular income deposits.

- Frequent NSF (Non-Sufficient Funds) occurrences indicating financial instability.

- Unverifiable or irregular income sources that do not align with lender requirements.

- Insufficient monthly income below the required threshold of $1,200.

- Absence of a steady source of income, such as employment or government benefits.

The Features and Benefits of Payday Loans in Abbotsford, BC

Payday loans in Abbotsford, BC, offer a straightforward financial solution with loan amounts ranging from $100 to $1,500, designed to align repayment with the borrower's next paycheck. These loans are particularly appealing due to their no credit check policy, allowing fast approval based on income stability rather than credit scores. With e-transfer funding and 24/7 online application availability, borrowers can swiftly access funds without the hassle of visiting a physical location, ensuring a convenient and efficient process. For residents seeking additional options, same-day payday loans are also available in neighboring cities like Brantford, Ontario for those needing immediate emergency funds.

Loan Amounts and Repayment Terms

When individuals in Abbotsford, BC, find themselves facing unexpected expenses, payday loans can present a viable solution to bridge the financial gap. These loans offer flexibility with loan limits ranging from $100 to $1,500, depending on the borrower's income and lender's policies. Repayment timelines are typically aligned with the borrower's next paycheck, spanning 14 to 62 days as dictated by provincial regulations. Payday loans are particularly appealing for those with bad credit, as they do not require a credit check; instead, lenders emphasize income stability. The convenience of e-transfer funding allows borrowers to access cash swiftly, often within hours. Additionally, online applications are available 24/7, ensuring accessibility even during weekends and holidays. Borrowers can trust in regulated and transparent lending practices.

- Loan limits range from $100 to $1,500

- Repayment timelines coincide with the next paycheck

- No credit check required, emphasizing income stability

- Funds disbursed quickly via e-transfer

- 24/7 online application availability

No Credit Check and Fast Approval Process

In Abbotsford, BC, many individuals find themselves seeking financial assistance for various unforeseen expenses. Payday loans offer significant loan flexibility and economic accessibility, particularly for those with bad credit. The appeal lies in the fast approval process, which doesn't require a credit check, concentrating instead on the applicant's income stability. This makes payday loans a viable option for many who face fiscal hurdles. The absence of credit checks guarantees that those with no credit or past difficulties can still access necessary funds. This process highlights the convenience of obtaining a loan quickly, providing crucial support during emergencies. With clear lending practices in place, borrowers can confidently navigate their economic requirements, knowing that provincial regulations offer protection and transparency.

E-Transfer Funding and 24/7 Online Applications

Exploring the landscape of short-term lending in Abbotsford reveals a dynamic and accessible solution for those facing urgent financial requirements. Payday loans offer e-transfer convenience and online accessibility, allowing borrowers to access funds swiftly without the need for physical visits. The flexibility of 24/7 online applications ensures that individuals can apply at their convenience, whether late at night or during holidays. This approach caters to the immediate needs of borrowers, providing a seamless experience.

- E-transfer funding: Quick access, often within 1-2 hours of approval.

- No physical location needed: Funds are received directly into bank accounts.

- 24/7 availability: Apply anytime, even on weekends.

- Bad credit acceptance: Ideal for those with poor credit histories.

- Regulated practices: Guarantees transparency and fairness for borrowers.

Applying for Payday Loans in Abbotsford, BC: A Step-by-Step Guide

Applying for payday loans in Abbotsford, BC, can be a straightforward experience, thanks to the convenience of online platforms available 24/7. Prospective borrowers simply need to visit the lender's website, complete the quick application form with necessary details such as government-issued ID and proof of income, and submit it without the need for an in-person visit. After approval, applicants receive a loan agreement with clear terms, and funds are typically transferred via e-Transfer within a couple of hours, making this a practical solution for urgent monetary requirements. Even individuals with bad credit in BC can apply for emergency funding options that offer fast approvals without traditional credit checks.

How to Apply for Payday Loans in Abbotsford, BC Online

Maneuvering the process of applying for a payday loan in Abbotsford, BC online is straightforward and efficient, allowing potential borrowers to address their fiscal requirements with ease. The online application is designed to be user-friendly, minimizing the hassle associated with traditional loan processes. Applicants can expect a quick and seamless experience, available 24/7, even on weekends. Submitting required documents is simple, ensuring that users spend less time worrying about paperwork and more time concentrating on their needs. The steps include:

- Visiting the lender’s website.

- Filling out the online application form.

- Providing personal and financial details.

- Submitting any necessary documentation.

- Receiving updates via email or phone.

This process eliminates the need for in-person visits, offering a modern solution to emergency economic needs.

What Information Do You Need to Apply?

Understanding how to apply for a payday loan in Abbotsford, BC, involves knowing the necessary steps and information required for a smooth process. Applicants must meet specific application requirements to guarantee document verification is seamless. Key information includes a government-issued ID for identity verification, proof of income like pay stubs or benefits from EI, CPP, or other sources, and active Canadian bank account details to receive e-Transfer funds. Providing a valid phone number and email address is essential for receiving updates on the application status. Unlike traditional loans, payday lenders bypass credit checks, concentrating instead on verifying income and banking activity. This streamlined approach allows for a quick, efficient application process, rendering it obtainable to those in need.

What Happens After Approval?

Securing approval for a payday loan in Abbotsford, BC, opens the door to immediate monetary relief. Once approved, borrowers can expect a streamlined process designed to swiftly meet their monetary requirements. Post approval expectations include receiving a loan agreement, which outlines terms and due dates. Loan funds are typically sent via e-Transfer, often within 1-2 hours during business hours. Automatic repayment is scheduled on the borrower’s next payday, ensuring a hassle-free experience.

Key aspects to anticipate after approval:

- Receiving a detailed loan agreement with clear terms

- Funds transferred quickly via e-Transfer

- Automatic repayment aligned with borrower’s payday

- Application follow up through email or phone

- Efficient handling of post approval expectations

This process underscores the convenience and speed of payday loans.

Understanding Payday Loan Costs and Repayments in Abbotsford, BC

Understanding the costs and repayments associated with payday loans in Abbotsford, BC, is essential for any potential borrower, as these short-term financial solutions come with specific financial commitments. Typically, the cost is regulated at $14 per $100 borrowed, meaning that a $500 loan would require a total repayment of $570, highlighting the importance of budgeting effectively to meet repayment deadlines and avoid additional charges. Missing a payment can lead to NSF fees from both the lender and the bank, so it is advisable for borrowers to contact their lender immediately to explore resolution options and prevent further financial consequences. While Abbotsford has its specific regulations, borrowers should be aware that same-day payday loans are also available in other Canadian cities like Edmonton with similar fee structures but potentially different provincial regulations.

How Much Do Payday Loans Cost in Abbotsford, BC?

In Abbotsford, BC, the cost of payday loans is strictly regulated to guarantee fairness and transparency for borrowers. Payday loan fees are set at $14 per $100 borrowed, as mandated by provincial laws. This secures that all borrowers pay a consistent rate, fostering transparency. For instance, a $500 payday loan costs a total of $570 upon repayment. Understanding these costs aids in developing effective repayment strategies. Borrowers should be aware of:

- Standardized fees across the province

- Repayment amounts due on the next payday

- Potential NSF fees for missed payments

- Legal compliance ensuring fair practices

- Fixed costs preventing unexpected charges

These guidelines provide a structured framework for managing payday loan commitments in Abbotsford, securing borrowers are informed and prepared.

Tips for Managing Payday Loan Repayments

Payday loans in Abbotsford, BC, come with standardized fees, offering borrowers a reliable cost structure that is regulated by provincial laws. To manage these repayments effectively, borrowers should consider budgeting tips and repayment strategies. Setting aside funds immediately upon receiving the loan can help guarantee the repayment amount is readily available when due. Knowing the exact due date is essential, as it typically aligns with the borrower's next payday, reducing the risk of missed payments. Borrowers might also benefit from setting up automatic payments to avoid late fees and NSF charges. By being proactive and organized, individuals can manage their payday loan repayments smoothly, maintaining their financial health while adhering to the loan terms.

What Happens If You Miss a Payment?

Steering through the world of payday loans in Abbotsford, BC, requires an understanding of the associated costs and repayment obligations. Missing a payment can lead to several financial hurdles. Payment consequences often include additional charges like NSF fees from both the lender and the bank. Missed deadlines might trigger collection efforts, impacting the borrower's credit history. It is essential to act promptly if payments are missed to mitigate further issues. Borrowers should be aware of the following:

- NSF fees may apply.

- Collection efforts could escalate.

- Credit bureau reporting might occur.

- Immediate lender contact is advised to resolve late payments.

- Potential legal action if issues remain unresolved.

Proactive communication with lenders is key to managing payment challenges effectively.

Borrowing Responsibly: Making Payday Loans in Abbotsford, BC Work for You

When considering payday loans in Abbotsford, BC, it's important to understand when these loans can be beneficial, such as during emergencies or unexpected financial gaps. To prevent over-reliance on payday loans, individuals should explore strategies like building an emergency savings fund and managing budgets effectively. Additionally, residents can look into local alternatives, such as borrowing from family or negotiating payment plans with service providers, to guarantee that payday loans remain a short-term solution rather than a primary financial strategy. For those facing credit challenges, looking into no credit check loans available in neighboring Alberta might provide additional borrowing options with potentially different terms and requirements.

When Should You Use a Payday Loan?

Could it be that payday loans offer a lifeline in times of unexpected financial stress? These short-term solutions are often considered a viable option when facing emergency situations. They can be particularly helpful for:

- Emergency expenses like urgent medical bills or car repairs.

- Avoiding NSF fees or utility shut-offs when cash is low before payday.

- Bridging unexpected financial gaps due to payroll delays.

- Covering urgent home repairs that can't wait until the next paycheck.

- Managing sudden expenses when other funds are temporarily unavailable.

It's important to recognize that payday loans are designed as short-term tools, not long-term financial strategies. By understanding their purpose and limitations, borrowers in Abbotsford can use payday loans wisely, ensuring they serve as a beneficial resource in times of need.

How to Avoid Over-Reliance on Payday Loans

While payday loans can provide quick relief during financial emergencies, it's essential to approach them with a strategy that prevents over-reliance. Developing savings strategies and employing effective budgeting techniques are vital steps in this process. Building an emergency savings fund can help individuals manage cash flow disruptions without resorting to payday loans repeatedly. Budgeting techniques, such as tracking expenses and prioritizing needs over wants, can also play a significant role in financial stability. Over-reliance on payday loans may lead to a cycle of debt, complicating financial management further. By implementing these strategies, individuals can maintain better control over their finances and use payday loans only when absolutely necessary.

| Strategy | Benefit | Implementation |

|---|---|---|

| Savings Fund | Cushion for emergencies | Set aside monthly |

| Budgeting | Improved cash flow | Track expenses |

| Prioritization | Avoid unnecessary debt | Distinguish needs |

Payday Loan Alternatives in Abbotsford, BC

Dealing with fiscal difficulties can be intimidating, yet payday loans in Abbotsford, BC, can be a practical solution when used wisely. However, exploring payday loan alternatives can provide more sustainable economic relief. Community resources and financial education play essential roles in managing finances effectively. Borrowers can consider:

- Seeking assistance from family or friends for immediate support.

- Utilizing local community programs that aid with essential expenses.

- Negotiating payment arrangements with utility companies or landlords.

- Establishing an emergency savings fund for future financial obstacles.

- Implementing budgeting strategies to enhance cash flow management.

It's imperative to understand that payday loans should not be the primary economic solution. By leveraging these alternatives, individuals can make informed decisions that support long-term financial stability while minimizing dependency on short-term loans.

FAQs About Payday Loans in Abbotsford, BC

Payday loans in Abbotsford, BC, serve as short-term financial solutions designed to help individuals manage urgent expenses until their next payday, providing a transparent and regulated option that's easily accessible online. These loans can be obtained without a traditional credit check, making them a viable option for individuals with bad credit or no credit history, as lenders focus on income stability and bank account activity to determine eligibility. One of the key benefits of payday loans is the speed at which funds can be accessed, with approved loans typically funded via e-Transfer within 1-2 hours during business hours, though actual funding times may vary based on the borrower's bank processing times. For those seeking alternative options outside Abbotsford, payday loans in Richmond are also readily available for residents throughout British Columbia needing immediate financial assistance.

What Are Payday Loans in Abbotsford, BC and How Do They Work?

In the bustling city of Abbotsford, payday loans stand as a practical solution for addressing immediate financial requirements. These short-term financial aids are designed to cover urgent expenses until the next payday. Available online, payday loans are regulated and transparent, offering quick access to funds. However, they come with both benefits and risks.

- Payday loan benefits: Quick access to cash for emergencies.

- Payday loan risks: High fees if not repaid promptly.

- Regulation: Governed by provincial laws to guarantee fairness.

- Accessibility: Available online with minimal requirements.

- Short-term solution: Not suitable for long-term financial planning.

Understanding the nature of payday loans is essential, as they are not long-term borrowing solutions and should be used responsibly to avoid potential pitfalls.

Can You Get a Payday Loan in Abbotsford, BC Without a Credit Check?

While many might worry about credit checks when seeking financial help, getting a payday loan in Abbotsford, BC, without this hurdle is indeed possible. Payday loans in this region do not require a traditional credit assessment, making them a viable option for individuals with bad credit or no credit history. Instead of relying on a credit score, lenders like Mr. Payday focus on income stability and bank account activity to determine loan eligibility. This approach guarantees that more people have access to short-term financial solutions. Borrowers can feel reassured knowing that payday lenders adhere to strict regulations to promote responsible lending practices. By prioritizing income and bank account activity over credit checks, payday loans offer a straightforward path to obtaining necessary funds.

How Quickly Can You Receive Payday Loan Funds in Abbotsford, BC?

Steering through the world of payday loans without the concern of a credit check opens doors for many individuals encountering economic hurdles. In Abbotsford, BC, the speed at which payday loan funds are received is a significant advantage. With fast processing and e-transfer benefits, approved loans are typically disbursed within 1-2 hours during business hours. This efficiency is highly appealing for those needing quick monetary relief.

- Applications processed online 24/7.

- E-transfer guarantees funds are received swiftly.

- Fast processing surpasses traditional banking options.

- Approval contingent on income stability, not credit score.

- Funding time may vary with bank processing times.

This swift service makes payday loans an attractive option for urgent, short-term monetary requirements, emphasizing the convenience and accessibility they offer.

Conclusion: Get Fast, Reliable Payday Loans in Abbotsford, BC Today

Mr. Payday stands out as a trusted provider of payday loans in Abbotsford, BC, offering a transparent and secure borrowing experience as a direct lender. By adhering to provincial regulations and ensuring no hidden fees, they provide a clear and straightforward service, with the added convenience of 24/7 online applications and same-day e-Transfer funding. For those in Abbotsford facing unexpected expenses, applying for a payday loan with Mr. Payday can be an efficient and hassle-free solution, allowing individuals to access funds quickly and easily—get the cash you need today by applying online now! If you're in neighboring areas, same-day payday loans in Coquitlam are also available with similar benefits and convenience.

Why Mr. Payday Is a Trusted Payday Loan Provider in Abbotsford, BC

When considering a reliable payday loan provider in Abbotsford, BC, many residents turn to Mr. Payday. This trusted lender offers several benefits, ensuring a seamless borrowing experience. Their transparent approach follows provincial regulations, providing clear pricing without hidden fees. Residents benefit from a 24/7 online application process, allowing them to apply whenever convenient. Mr. Payday stands out for its fast approvals and efficient same-day e-transfer funding, making it a favored option for those facing unexpected expenses. Additionally, the absence of credit checks simplifies the borrowing process for those with varying credit histories.

- Direct lender for transparency

- Provincial regulation compliance

- 24/7 online application availability

- Fast approval and funding

- No credit checks needed

These insights highlight why Mr. Payday is a leading choice in Abbotsford.

Apply Now for Same-Day E-Transfer Payday Loans in Abbotsford, BC

Residents of Abbotsford looking for quick financial support often find a dependable solution in payday loans, particularly with a trusted provider like Mr. Payday. Offering payday loan advantages such as fast access and financial relief, Mr. Payday stands out with its same-day e-transfer service. The process is simple: apply online at any time, ensuring funds are available when needed most. Borrowers benefit from a clear, transparent system devoid of hidden fees, making it a practical choice for managing urgent expenses.

| Feature | Details |

|---|---|

| Loan Amount | $100 – $1,500 |

| Application Mode | Online, 24/7 availability |

| Funding Speed | Same-day e-transfer |

| Credit Check | Not required |

Get the cash you need today—apply online now!