Payday loans in Abbotsford offer quick financial relief for unexpected expenses between paycheques. You'll need to be at least 19, have a steady income of $1,200+ monthly, and maintain an active Canadian bank account. The application process is entirely online, with funds transferred within 30 minutes of approval. Provincial regulations cap fees at $14 per $100 borrowed, making costs transparent. Understanding your options and responsibilities helps guarantee these short-term solutions work effectively for your emergency needs.

Payday Loans in Abbotsford, BC: Fast and Reliable Online Cash Solutions

Payday loans in Abbotsford, BC offer you quick access to cash when unexpected expenses arise between paychecks. You'll find these short-term loans especially advantageous if you need immediate funds for emergencies like car repairs, medical bills, or utility payments that can't wait until your next payday. Whether you have good credit, bad credit, or no credit history, payday loans in Abbotsford can provide a financial solution when traditional banks might turn you away. Many lenders offer same-day payday loans for Abbotsford residents who need emergency funds without delay.

What Are Payday Loans in Abbotsford, BC?

Financial emergencies can strike anyone at any time in Abbotsford, leaving residents searching for quick cash solutions when unexpected expenses arise. Payday loans are small, short-term loans that help bridge the gap between paychecks when you face urgent costs. These payday loan benefits offer Abbotsford residents a way to handle financial emergency solutions without traditional credit checks.

- Available 24/7 through online applications for maximum convenience

- Designed for short-term use to cover immediate expenses like car repairs or medical bills

- Accessible to almost everyone, including those with bad credit histories

- Regulated by BC provincial laws to protect consumers with transparent fee structures

With fast funding through e-transfer, payday loans provide a practical option when you need money quickly without the lengthy approval process of conventional loans.

Benefits of Using Payday Loans in Abbotsford, BC

When unexpected expenses hit your budget in Abbotsford, quick access to cash can make a significant difference in resolving urgent matters without delay. Payday loans offer solutions during times when you face car repairs, medical bills, or utility payments that can't wait until your next paycheck.

These loans provide several payday loan benefits that traditional options don't match. You can apply online 24/7 from home, with almost everyone approved regardless of credit history. For Abbotsford residents, these financial emergency solutions deliver cash through e-transfer, often within hours after approval.

The application process requires no complicated paperwork, and you don't need collateral to secure funds. With transparent fee structures and provincial regulations protecting consumers, payday loans help bridge short-term gaps when you need support most.

Who Should Consider Payday Loans in Abbotsford, BC?

Are you wondering if a payday loan could be the right solution for your short-term cash needs in Abbotsford? These loans work best for Abbotsford residents who find themselves caught between paychecks but face urgent expenses that can't wait. Responsible borrowing means understanding when payday loans make sense for your situation.

- Working adults with steady income who need to cover emergency car repairs

- Individuals with bad credit who can't qualify for traditional bank loans

- People facing unexpected medical bills or household emergencies

- Workers who have job security but temporary cash flow problems

Payday loan benefits include quick access to funds when traditional options aren't available. If you have a reliable income of at least $1,200 monthly and can repay the loan on your next payday, this short-term solution may help bridge your financial gap.

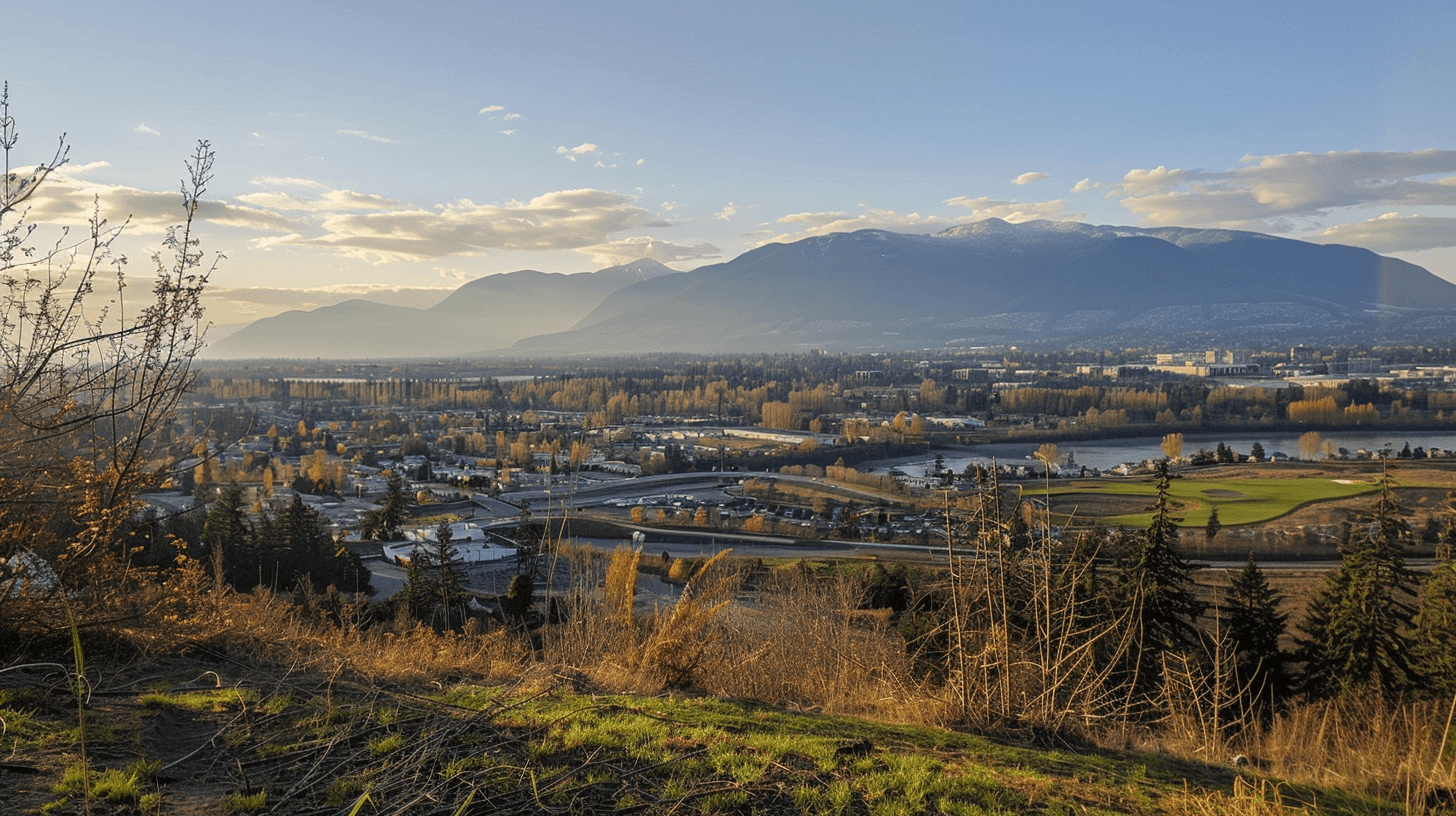

Living in Abbotsford, BC: Cost of Living and Financial Challenges

Living in Abbotsford has become increasingly expensive as housing costs continue to climb alongside rising prices for groceries, utilities, and transportation. You might notice financial stress affecting your daily life, with many residents reporting difficulties keeping up with monthly bills and experiencing increased anxiety about their financial situation. When unexpected expenses arise, such as car repairs or medical bills, payday loans can provide a short-term solution to bridge cash flow gaps between pay periods. For those with urgent monetary needs, fast payday loans are also available in nearby communities like Duncan, BC.

Rising Expenses in Abbotsford, BC and Their Impact

Abbotsford residents face increasing financial pressures as housing costs continue to climb throughout the Fraser Valley. With rising inflation affecting daily expenses, many households struggle to maintain stable financial planning. The 2025 economic outlook shows detached homes averaging $1.2 million while monthly costs for a single person can reach $3,535—38% cheaper than Vancouver but still challenging on a $48,040 average salary.

- Carbon tax increases add 3.3 cents per liter to gas prices starting April 2025

- Housing affordability remains problematic with an 8.7 price-to-income ratio

- Grocery costs average $527 monthly for typical households

- Transportation expenses reach $648 monthly for drivers, compared to $52 for bus passes

Despite government benefits like the Climate Action Tax Credit and BC Family Benefit helping offset some costs, many families find themselves caught between increasing expenses and static incomes.

How Financial Stress Affects Residents in Abbotsford, BC

Financial stress weighs heavily on many residents of Abbotsford, with local statistics mirroring the national trend where money troubles rank as the primary source of stress for 40% of Canadians. The impact goes beyond just money worries—36% face mental health challenges, 48% lose sleep, and 16% experience relationship strain due to financial concerns.

Rising costs of daily necessities hit hard, with 69% of residents stressed by high grocery prices. Recent immigrants face unique pressures, with 9.1% in low-income brackets compared to 8% of Canadian-born residents.

Improving financial literacy and seeking community support can help manage these stressors. Local not-for-profit organizations deliver significant economic impact—$1.8 billion in 2023—providing essential services when money gets tight. The increasing charitable sector growth shows how Abbotsford is responding to these widespread economic difficulties.

How Payday Loans Help Address Short-Term Cash Needs

When unexpected expenses arise in Abbotsford, payday loans offer a quick solution for residents facing short-term cash shortages. Many locals turn to these short term solutions when confronted with urgent bills or emergency costs between paychecks. The cash flow gaps that occur when timing doesn't align with expenses can create stress, but payday loans help bridge these temporary situations.

- Car repairs that can't wait until next payday

- Medical expenses not covered by provincial insurance

- Housing emergencies like broken appliances or urgent plumbing issues

- Avoiding late payment penalties on essential bills

Financial emergencies don't follow a schedule, which is why many Abbotsford residents value having access to quick funds without lengthy approval processes. For those with limited alternatives, these loans provide a practical option when traditional banking solutions aren't available.

Who Can Apply for Payday Loans in Abbotsford, BC?

You may wonder who can get a payday loan in Abbotsford and whether bad credit disqualifies you from borrowing. Understanding the basic eligibility requirements assists you in ascertaining if you qualify for this short-term funding option. Knowing why applications sometimes get rejected can prepare you for a successful application process if you decide a payday loan is right for your situation. Residents of Abbotsford with bad credit in BC can still explore emergency lending options that provide fast approval despite credit history concerns.

Basic Eligibility Criteria for Payday Loans in Abbotsford, BC

Payday loans in Abbotsford, BC remain open to almost everyone, including those with less-than-perfect credit histories or limited banking relationships. Understanding the eligibility requirements helps clear up common application misconceptions about who can apply. Mr. Payday welcomes BC residents aged 19 or older who meet basic criteria.

- You must have a steady income source of at least $1,200 monthly (can include employment, EI, CPP, CCB, or WCB benefits)

- An active Canadian bank account where your income is deposited is essential

- A reliable phone number for contact purposes is required

- No traditional credit check is performed, making these loans accessible for those with bad credit

Applications may be declined if your bank account is new, shows multiple NSF occurrences, or lacks regular income deposits.

Can You Get a Payday Loan in Abbotsford, BC with Bad Credit?

Bad credit often creates barriers to traditional loans, but payday loans in Abbotsford, BC provide a feasible solution for those with less-than-perfect credit histories. Unlike banks, Mr. Payday accepts applications from people with bad credit, no credit, or even past bankruptcies without running traditional credit checks.

Common credit misconceptions suggest everyone with poor credit gets rejected, but payday lenders focus primarily on your current income stability rather than credit history. You'll qualify if you're at least 19 years old in BC, have a minimum monthly income of $1,200, maintain an active bank account with direct deposits, and provide a working phone number. The income verification process accepts various sources including employment, EI, CPP, and Canada Child Benefit. Applications may only be denied if your bank account is new, shows multiple NSF transactions, or lacks regular income deposits.

Common Reasons Payday Loan Applications Are Rejected

When applying for payday loans in Abbotsford, BC, understanding what might cause a rejection can save you time and frustration. The application evaluation process at Mr. Payday looks at several factors to determine loan eligibility, and being aware of these can help you avoid common pitfalls.

- Bank accounts that are new or show little activity often trigger concerns during the review process

- Multiple NSF (Non-Sufficient Funds) instances in your banking history suggest potential repayment problems

- Income that falls below the required $1,200 monthly minimum will result in application denial

- Paychecks not directly deposited to your bank account make income verification difficult and may lead to rejection

Most rejections stem from banking history issues rather than credit problems, as Mr. Payday accepts applicants with bad credit.

The Features and Benefits of Payday Loans in Abbotsford, BC

Payday loans in Abbotsford offer amounts ranging from $100 to $1,500 based on your income level, with repayment terms typically aligning with your next paycheque. You can apply for these loans without worrying about credit checks, as lenders focus more on your income stability rather than credit history. The convenience of e-transfer funding means you can receive your approved loan quickly, while 24/7 online applications allow you to submit your request anytime you need money urgently. Similar to same-day payday loans in Edmonton, Abbotsford lenders prioritize fast processing for those facing emergency expenses.

Loan Amounts and Repayment Terms

Looking for quick cash in Abbotsford often leads residents to contemplate payday loans as a viable solution for short-term money needs. When you apply with Mr. Payday, you can access loan amounts ranging from $100 to $1,500, with the final amount based on your income level (up to 50% of your next paycheck).

- Loan types focus solely on short-term payday advances that bridge gaps between paychecks

- Repayment schedules align with your pay cycle, typically 14-62 days as per BC regulations

- All loans come with a transparent fee structure of $14 per $100 borrowed

- Repayment occurs automatically through a single bank account debit on your payday

These straightforward terms make payday loans in Abbotsford a clear option when you need funds quickly without complex commitments.

No Credit Check and Fast Approval Process

Many Abbotsford residents with bad credit histories can still qualify for payday loans through Mr. Payday. Unlike traditional lenders who scrutinize credit scores, Mr. Payday focuses on your income stability rather than past credit issues. This no credit check approach makes these loans accessible to almost everyone who meets basic requirements.

The approval process is designed for speed and simplicity. Once you submit your application online, Mr. Payday reviews your information quickly—often within an hour during business hours. After approval, funds are sent via email money transfer, typically within 30 minutes. This fast funding system helps address urgent expenses without delay. Whether you need cash for car repairs or unexpected bills, the streamlined process works around your schedule, available 24/7 for your convenience.

E-Transfer Funding and 24/7 Online Applications

When you're facing unexpected expenses in Abbotsford, the convenience of e-transfer funding makes payday loans a practical solution for quick cash requirements. Mr. Payday sends money directly to your bank account via email transfer, usually within 30 minutes of approval. This means you can handle emergency costs without waiting for checks to clear or visiting a physical location.

- Apply 24/7 from any device with internet access

- Receive funds via e-transfer the same day when approved during business hours

- Track your application status through your personal customer page

- No need to scan, fax, or email documents with the digital application process

The online convenience extends beyond just applying—you can complete the entire process from home while managing your urgent financial obligations in Abbotsford with minimal disruption to your schedule.

Applying for Payday Loans in Abbotsford, BC: A Step-by-Step Guide

Applying for payday loans in Abbotsford is a straightforward process that can help you manage unexpected expenses. You'll need to gather specific information before starting your application to guarantee a smooth experience. Understanding what happens after approval will prepare you for receiving and managing your loan funds effectively. If you're looking for similar financial solutions in neighboring cities, payday loans in Coquitlam offer comparable emergency funding options for British Columbia residents.

How to Apply for Payday Loans in Abbotsford, BC Online

Looking for payday loans in Abbotsford, BC online doesn't have to be complicated. The application process takes just minutes to complete and can be done from your home computer or smartphone 24/7. Mr. Payday offers a straightforward approach that allows almost everyone to get approved when they meet basic application requirements.

To apply for online payday loans in Abbotsford:

- Visit Mr. Payday's website and fill out the secure application form with your personal information

- Provide proof of income (minimum $1,200 monthly from employment, EI, CPP, or CCB)

- Submit banking details for verification and fund transfer

- Receive funds via email money transfer within 30 minutes of approval

The online convenience means you won't need to visit a physical location or fax documents. Applications are processed quickly during business hours, making cash available when you need it most.

What Information Do You Need to Apply?

Preparing for your payday loan application in Abbotsford requires having the right information at your fingertips before you begin. When applying for online payday loans, you'll need to provide specific borrower information to complete your application.

The basic application requirements include valid government-issued ID to verify your identity and age (19+ in BC). You must show proof of income of at least $1,200 monthly, which can come from employment, EI, CPP, WCB benefits, or Canada Child Benefit. You'll need details for an active Canadian bank account where your income is deposited and where funds can be sent via e-transfer. Remember to include a working phone number and email address so Mr. Payday can contact you about your application status and send your funds quickly if approved.

What Happens After Approval?

Once your payday loan application has been approved in Abbotsford, you'll enter the final stages of the borrowing process where everything moves quickly. The post approval process typically follows a structured sequence that guarantees you receive funds with minimal delay. You'll first receive a loan agreement that outlines all terms and conditions including repayment dates and amounts.

- You'll review and digitally sign your loan agreement containing all loan agreement details

- Funds are sent to your bank account via email money transfer, often within 30 minutes during business hours

- You'll get access to a personal customer page where you can track your loan status

- Repayment will be automatically scheduled to coincide with your next payday through bank account debit

Understanding Payday Loan Costs and Repayments in Abbotsford, BC

When you take out a payday loan in Abbotsford, BC, you'll pay fees regulated by provincial law that amount to $14 per $100 borrowed. Understanding these costs upfront helps you prepare for repayment on your next payday, which requires proper budgeting and awareness of your due date. If you miss a payment, you face potential NSF fees from both the lender and your bank, along with possible collection efforts that could impact your credit standing. In emergency situations, same-day payday loans are available to BC residents who need immediate access to funds.

How Much Do Payday Loans Cost in Abbotsford, BC?

Payday loans in Abbotsford, BC come with standardized costs that are regulated by provincial legislation to protect consumers. When you take out a payday loan in Abbotsford, you'll pay $14 for every $100 borrowed. This means a $500 loan would cost you $570 to repay on your next payday. These payday loan fees are fixed and transparent, making it clear what your repayment expectations will be.

- A $300 loan costs $342 to repay

- A $500 loan costs $570 to repay

- A $1,000 loan costs $1,140 to repay

- A maximum loan of $1,500 costs $1,710 to repay

Understanding these costs helps you make informed decisions about whether a payday loan fits your short-term cash needs and budget constraints.

Tips for Managing Payday Loan Repayments

Successfully managing your payday loan repayments starts with understanding your obligations and creating a solid plan. Mark your calendar with the exact due date—typically your next payday—to avoid missing payments and incurring additional charges.

Effective repayment strategies include setting aside the full amount as soon as you receive your loan. For a $500 loan in BC, plan to repay $570 on the due date. Consider creating a separate budget category just for this repayment to protect these funds from being spent elsewhere.

Budgeting tips that work include automating the payment through your bank to prevent NSF charges. Contact Mr. Payday immediately if you foresee any payment issues—waiting only compounds problems. Remember that each missed payment can trigger both lender and bank fees, potentially affecting your ability to borrow in the future.

What Happens If You Miss a Payment?

Missing a payment on your payday loan can trigger a series of consequences that impact both your finances and borrowing options. When your repayment doesn't go through on the scheduled date, Mr. Payday charges a minimum $20 NSF fee, while your bank may add their own fees too.

- Your account falls into collections status, which could lead to legal action if not addressed

- Mr. Payday may report missed payments to credit bureaus, affecting your credit history

- Additional fees accumulate, making the total amount owed higher than the original loan

- Your chances for future loan approval decrease, even with lenders who accept bad credit

If you anticipate repayment issues, contact Mr. Payday before your due date. They work with customers in BC to find solutions rather than letting missed payments escalate into bigger problems.

Borrowing Responsibly: Making Payday Loans in Abbotsford, BC Work for You

Payday loans can be valuable tools during genuine emergencies when you're facing unexpected car repairs, medical bills, or utility shutoffs before your next paycheck arrives. Your financial health depends on using these loans sparingly and having a concrete plan to repay them on your next payday without needing to reborrow. While payday loans offer quick cash access in Abbotsford, you might consider alternatives first, such as borrowing from family, negotiating payment plans with creditors, or seeking assistance from local community aid programs. If you're considering options in neighboring areas, same-day payday loans are also available in Chilliwack for residents facing urgent financial needs.

When Should You Use a Payday Loan?

Understanding when to use a payday loan in Abbotsford can help you make smarter financial decisions during challenging times. Payday loans work best as solutions for short-term cash needs rather than long-term financial issues. Before applying, consider if your situation truly calls for this type of loan.

- Car breakdowns that prevent you from getting to work

- Urgent home repairs like broken water pipes or heating failures

- Medical expenses not covered by provincial health insurance

- Avoiding utility disconnection when you're just days from your next paycheck

Good financial management means using payday loans only when absolutely necessary and having a clear plan to repay on your next payday. Remember that these loans address immediate emergency expenses but shouldn't become your go-to solution for ongoing budget shortfalls.

How to Avoid Over-Reliance on Payday Loans

While payday loans can be a helpful tool during financial emergencies, they work best when used strategically and sparingly. Creating a monthly budget that tracks income and expenses can help you identify areas where you can cut costs and build savings. Even setting aside $25 from each paycheck adds up over time, creating a buffer for unexpected expenses.

Financial literacy plays a key role in breaking the cycle of short-term borrowing. Consider using free budgeting strategies like the 50/30/20 rule (needs/wants/savings) to manage your money better. When cash is tight, explore alternatives first: ask about payment plans with creditors, check with local community assistance programs, or consider a small loan from family. These approaches can help you maintain control of your finances without repeated borrowing.

Payday Loan Alternatives in Abbotsford, BC

Residents of Abbotsford facing short-term cash shortages have several alternatives to explore before turning to payday loans. Abbotsford offers community resources designed to help during tough times, giving you options that might better suit your situation.

- Credit unions like Abbotsford's Envision Financial offer small personal loans with lower interest rates and more manageable repayment terms

- The Salvation Army and Abbotsford Community Services provide emergency assistance for essential expenses like utilities and rent

- Local financial education workshops through the Abbotsford Public Library help develop budgeting skills to prevent future cash crunches

- Many employers in Abbotsford offer payroll advances when employees face unexpected expenses

These alternatives often come with fewer fees and less pressure than payday loans, making them worth considering before committing to higher-cost borrowing options.

FAQs About Payday Loans in Abbotsford, BC

When you're considering a payday loan in Abbotsford, BC, you likely have questions about how the process works. Understanding the basics—including application requirements, approval criteria, and funding timelines—can help you make an informed borrowing decision. Below, we've answered the most common questions to guide you through the payday loan landscape in Abbotsford. Many residents find it helpful to compare local options with payday loans in Alberta, which have specific provincial regulations governing their interest rates and terms.

What Are Payday Loans in Abbotsford, BC and How Do They Work?

Payday loans in Abbotsford provide a straightforward financial solution for BC residents facing unexpected expenses between paychecks. These short-term loans help bridge the gap until your next income arrives, without the hassle of traditional credit checks. Unlike bank loans, payday loan features focus on speed and simplicity rather than long approval processes.

- Loans range from $100 to $1,500 (up to 50% of your paycheque)

- You must be 19+ years old with a minimum monthly income of $1,200

- Application happens entirely online, with no documents to fax or email

- Funds transfer to your account via email money transfer after approval

Meeting eligibility requirements is simple – you'll need a bank account where your income is deposited and a reliable phone number to qualify for consideration.

Can You Get a Payday Loan in Abbotsford, BC Without a Credit Check?

Yes, you can absolutely get a payday loan in Abbotsford without undergoing a traditional credit check. Mr. Payday, a direct lender serving British Columbia since 2002, focuses on your income stability rather than your credit history when evaluating applications.

Instead of looking at your credit score, lenders follow payday loan regulations by verifying your income and banking information. Common income verification methods include reviewing your regular deposits and banking activity. This approach makes these loans accessible to those with bad credit, no credit, or past bankruptcies.

To qualify, you must be 19 or older, earn at least $1,200 monthly from employment, EI, WCB, CPP, or CCB, and have an active bank account. The application process is completely online and available 24/7, offering a practical solution for unexpected expenses.

How Quickly Can You Receive Payday Loan Funds in Abbotsford, BC?

Getting your hands on cash quickly is often the primary reason people in Abbotsford turn to payday loans. When you apply with Mr. Payday, the loan processing happens much faster than with traditional banks. Applications submitted during business hours can be approved and funded within the same day, sometimes in as little as an hour.

- Approved loans are sent via email money transfer, typically within 30 minutes of approval

- Online applications are processed 24/7, though funding depends on your bank's processing times

- Weekend applications may be processed, but most funding occurs during Monday-Friday business hours

- The entire process from application to cash in your account can be completed without leaving your home

Conclusion: Get Fast, Reliable Payday Loans in Abbotsford, BC Today

When you need quick cash in Abbotsford, Mr. Payday offers a straightforward solution with our online payday loans available around the clock. As a direct lender operating since 2002, we follow all provincial regulations while providing transparent lending with no hidden fees or surprises. You can complete your application in minutes, receive almost guaranteed approval if you meet our criteria, and get funds sent via e-Transfer typically within 30 minutes of approval. If you're in nearby areas, we also offer same-day payday loans for residents in Burnaby who need emergency financial assistance.

Why Mr. Payday Is a Trusted Payday Loan Provider in Abbotsford, BC

Mr. Payday stands as a trusted payday loan provider in Abbotsford, giving you the financial support you need when unexpected expenses pop up. As a direct lender operating under BC regulations, we offer transparent lending with clear terms. Our online application system helps Abbotsford residents access cash quickly without visiting a physical location.

Payday loan benefits with Mr. Payday advantages include:

- 24/7 online application process for your convenience

- Fast approvals with same-day e-Transfer funding

- No credit checks, making loans available to almost everyone who meets basic criteria

- Straightforward fee structure of $14 per $100 borrowed

Apply now and get the cash you need today. Our simple process lets you handle emergency expenses without delay, putting money in your bank account when you need it most.

Apply Now for Same-Day E-Transfer Payday Loans in Abbotsford, BC

Applying for a payday loan in Abbotsford has never been simpler with Mr. Payday. As a direct lender operating since 2002, we offer a safe, transparent borrowing experience that follows BC regulations. Our online application process works 24/7, letting you apply whenever money troubles hit.

The payday loan benefits you'll enjoy include no credit checks, approval even with bad credit history, and funds sent by e-transfer within 30 minutes of approval. For residents facing car repairs, medical bills, or other surprise costs, we provide quick solutions without the bank hassle.

Don't let cash shortages stress you out. Complete our straightforward application now and possibly receive up to $1,500 today. Get back on track with Mr. Payday's fast, reliable service.